NOVOMATIC Launches Unconditional Takeover Offer for Ainsworth, Backed by Board Recommendation

Wednesday 20 de August 2025 / 12:00

2 minutos de lectura

(Gumpoldskirchen / Newington).- NOVOMATIC announces a best and final unconditional cash offer of A$1.00 per share for Ainsworth Game Technology. The offer is board-recommended and runs alongside the existing Scheme of Arrangement.

Europe’s leading gaming technology group, NOVOMATIC AG Group (NOVOMATIC), has officially launched an unconditional, board-recommended cash takeover offer for all outstanding shares in Ainsworth Game Technology Limited (Ainsworth) at A$1.00 per share. This "best and final" offer runs in parallel with NOVOMATIC’s existing Scheme of Arrangement and provides Ainsworth shareholders with immediate liquidity and strategic clarity.

Currently holding a 52.9% majority stake in Ainsworth, NOVOMATIC is eligible to purchase additional shares on-market at or below the offer price.

Ainsworth Board Endorses Takeover Offer

Ainsworth’s Independent Board Committee has unanimously recommended the Takeover Offer, as well as the Scheme Offer, in the absence of a superior proposal. The recommendation is subject to the Independent Expert continuing to find the offer fair and reasonable, or not fair but reasonable, to Ainsworth shareholders.

Both the Takeover and Scheme Offers reflect a 35% premium over Ainsworth’s share price prior to the initial announcement and fall within the Independent Expert’s valuation range.

Shareholder Consideration and Dividends

The A$1.00 per share Takeover Offer mirrors the Scheme Implementation Deed executed on April 28, 2025. A vote on the Scheme is currently scheduled for August 29, 2025, although NOVOMATIC anticipates Ainsworth may apply to postpone the meeting in light of the new offer.

Under the Scheme, shareholders could receive a fully franked dividend of A$0.19 per share, with the remainder of the A$1.00 consideration paid in cash. This structure offers eligible shareholders up to A$1.08 in total value per share, thanks to the added franking credit benefit—an advantage not available under the Takeover Offer.

Strategic Intentions

If the Scheme is approved, NOVOMATIC plans to seek delisting of Ainsworth upon reaching a 75% shareholding threshold, which would significantly reduce market liquidity.

Should the Scheme not proceed, NOVOMATIC will pursue a more active management role, including:

Increasing representation on Ainsworth’s Board,

Initiating a strategic business review, including operations, capital structure, dividend policy, and funding strategies.

Executive Statement

Stefan Krenn, Executive Board Member of NOVOMATIC AG Group, emphasized the benefits of the unconditional offer: “This offer provides immediate liquidity and empowers all shareholders to make their own decision, regardless of the Scheme outcome. While certain shareholders, including members of the Ainsworth family, may oppose the Scheme, our Takeover Offer returns control to individual shareholders."

He added: “The acquisition aligns with our global expansion strategy, particularly in the Asia-Pacific and U.S. markets. We are committed to leveraging our majority stake to drive long-term value and enhance alignment between investment and decision-making.”

Next Steps

Shareholders are urged to review NOVOMATIC’s Bidder’s Statement for full details on the Takeover Offer and intentions. The Scheme Booklet remains a key source for information on the Scheme, including the notice of meeting and Independent Expert’s report.

Keywords: NOVOMATIC takeover offer, Ainsworth shareholders, Ainsworth board recommendation, gaming industry news, Ainsworth NOVOMATIC acquisition, A$1.00 share offer, Ainsworth Scheme of Arrangement, gaming investment Australia.

Categoría:Others

Tags: NOVOMATIC, Ainsworth,

País: Austria

Región: EMEA

Event

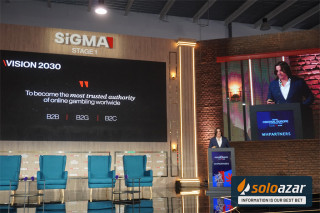

SiGMA Central Europe

03 de November 2025

Uplatform Captivates SiGMA Central Europe 2025: Fresh Ideas, Juicy Results

(Cyprus).- At Fiera Roma, where countless booths fought for attention, only one stopped attendees in their tracks and sparked the reaction, “You have to see this”—Uplatform’s standout showcase.

Thursday 20 Nov 2025 / 12:00

SiGMA Central Europe: An Exclusive Conversation with GR8 Tech’s Chief Sales Officer Yevhen Krazhan

(Rome, SoloAzar Exclusive).- In this interview, Yevhen Krazhan, Chief Sales Officer at GR8 Tech, discusses the cutting-edge products and solutions showcased at SiGMA Central Europe, the audience’s enthusiastic response, and how GR8 Tech is carving out a strong position in high-growth regions such as MENA, Africa, and Latin America.

Thursday 20 Nov 2025 / 12:00

Belatra Showcases Innovation and Expansion Strategy at SiGMA Central Europe

(Rome, SoloAzar Exclusive).- Belatra Games made a powerful impression at SiGMA Central Europe, where Chief Marketing Officer Kateryna Goi unveiled the company’s latest titles and strategic vision. The booth buzzed with excitement as visitors explored novelties such as Long Neck Fortune, Goose Boom Bang, and Fortune Mummy, alongside the centerpiece attraction—the Mummyverse, a connected universe of thrilling slot experiences. Read more about company’s growth and future expansion across Europe.

Wednesday 19 Nov 2025 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.